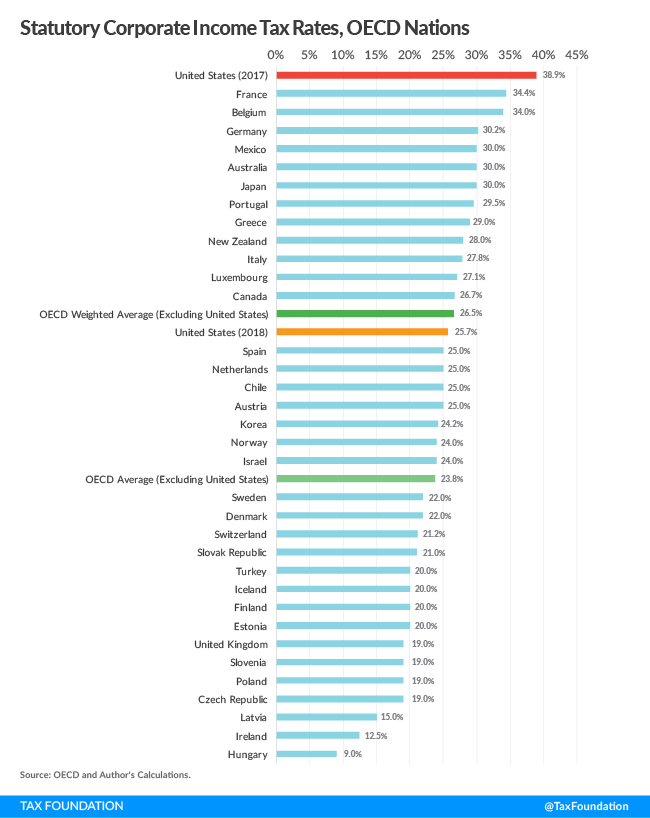

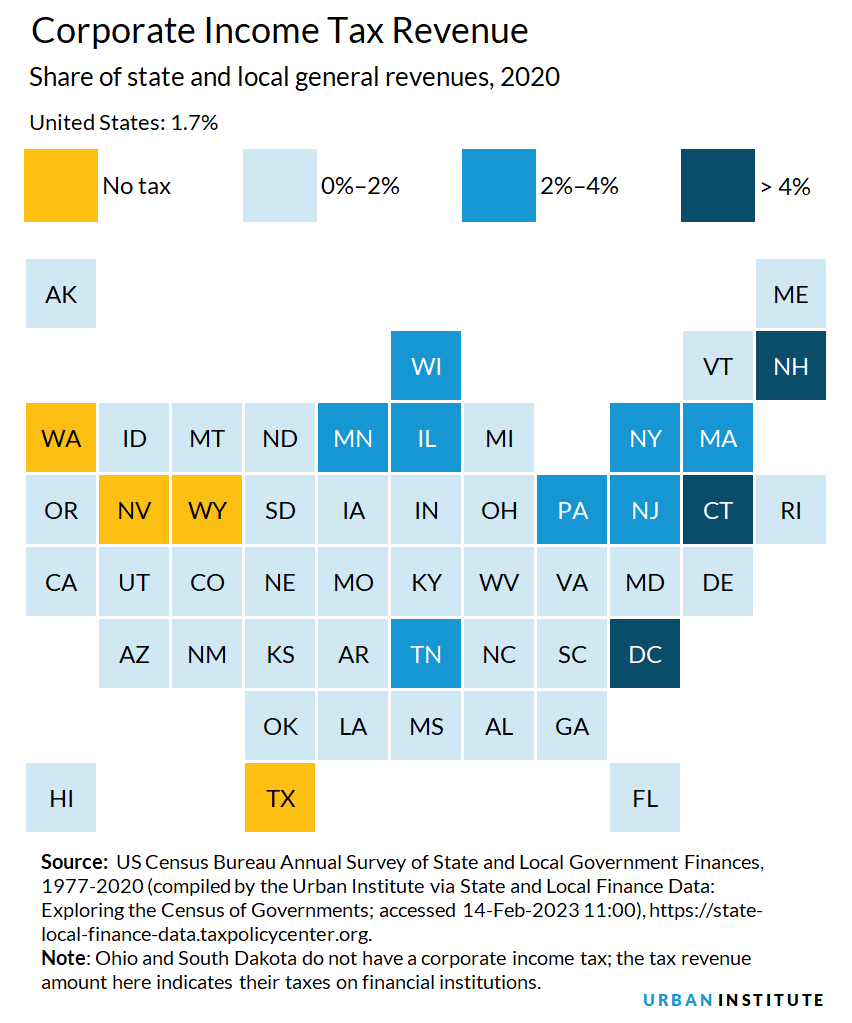

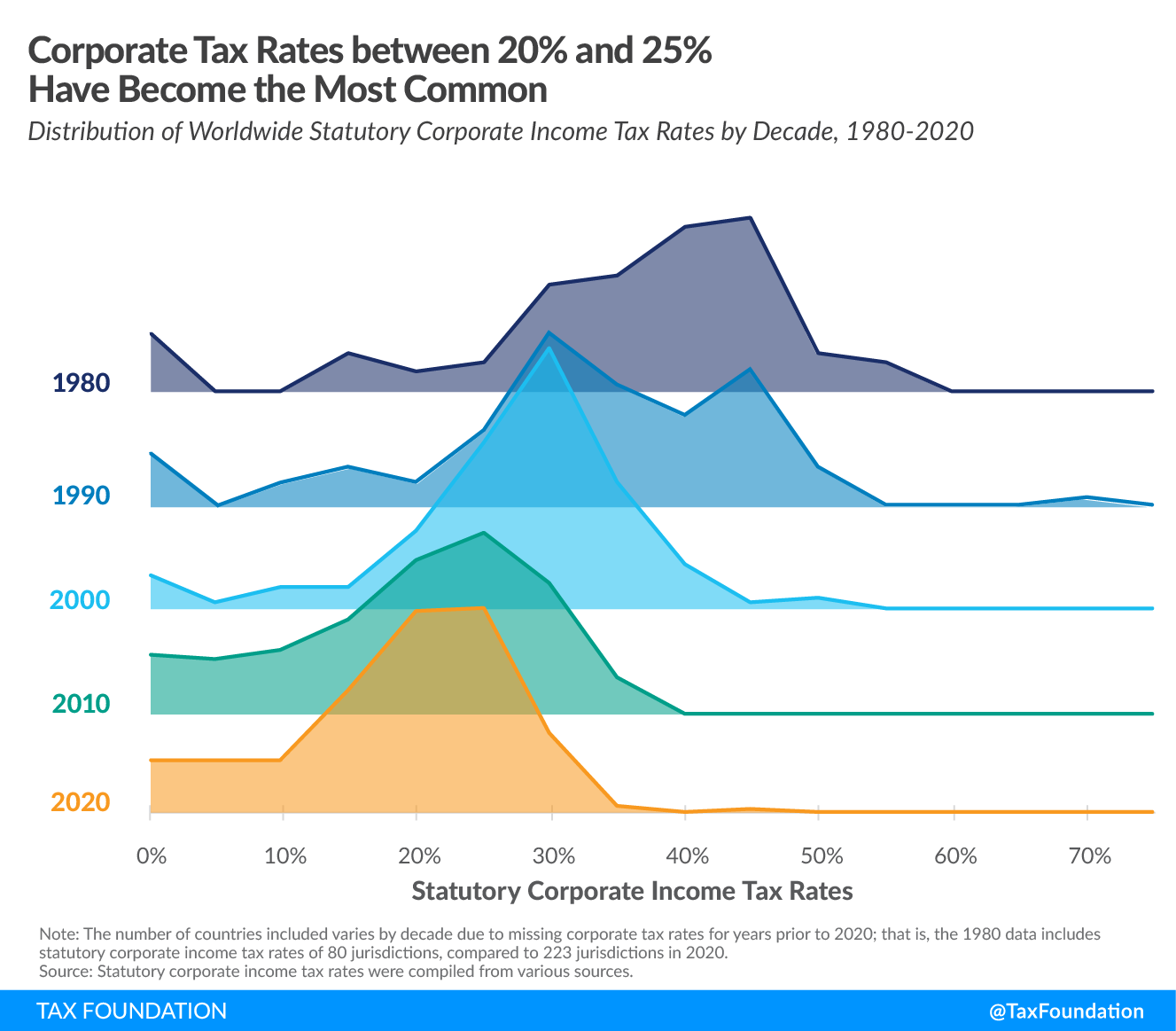

Tax Foundation on Twitter: "Prior to 2017 federal tax reform, the U.S. had the fourth highest corporate income tax rate in the world. It now ranks in the middle of the pack,

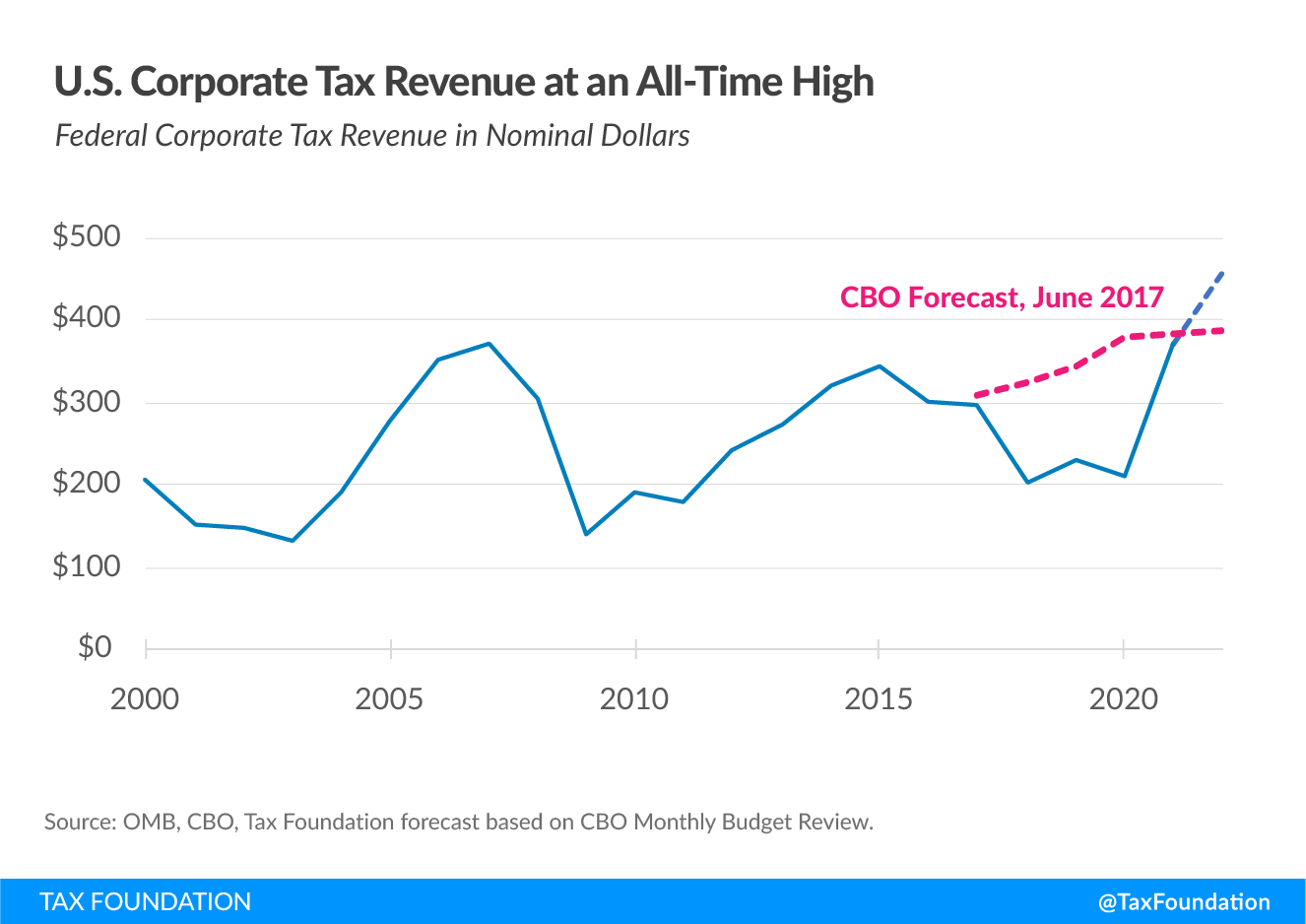

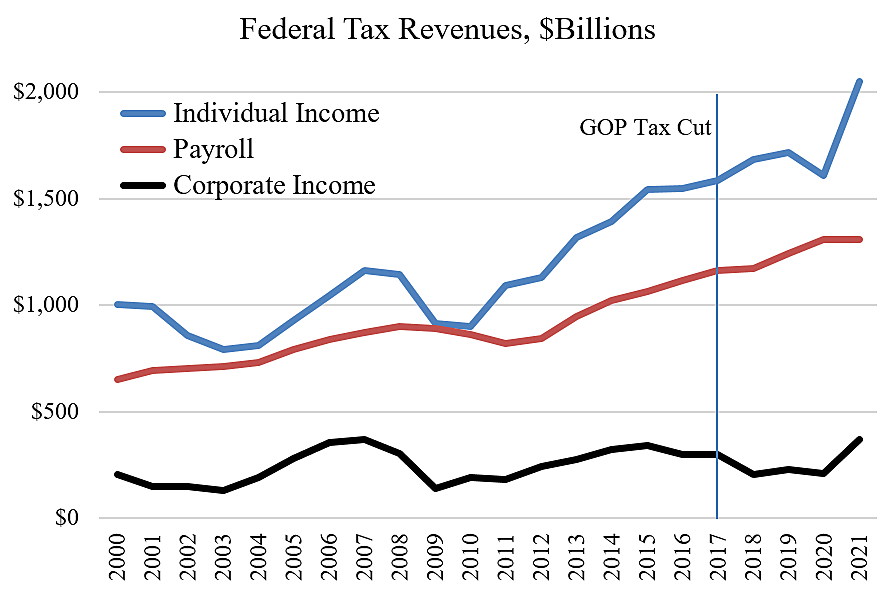

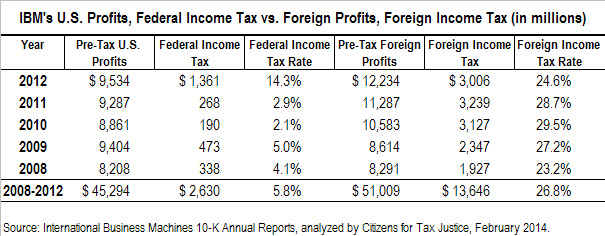

Taxes on Corporate Profits – Low, Falling for Decades, And Now Close to a Voluntary Tax | An Economic Sense

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)